✆ + 1-646-235-9076 ⏱ Mon - Fri: 24h/day

Implementing Subscriptions with Stripe: Lessons from the Field

Stripe remains one of the most popular choices for managing recurring billing, offering a flexible and developer-friendly toolkit for platforms of all sizes. But beyond the sleek documentation and quick-start examples lies a reality that’s far more nuanced, especially when building for production at scale.

This article outlines common challenges and insights gained from Implementing Subscription with Stripe in a real-world product, covering everything from event handling to payment failures, ACH delays, proration rules, and accounting for fees.

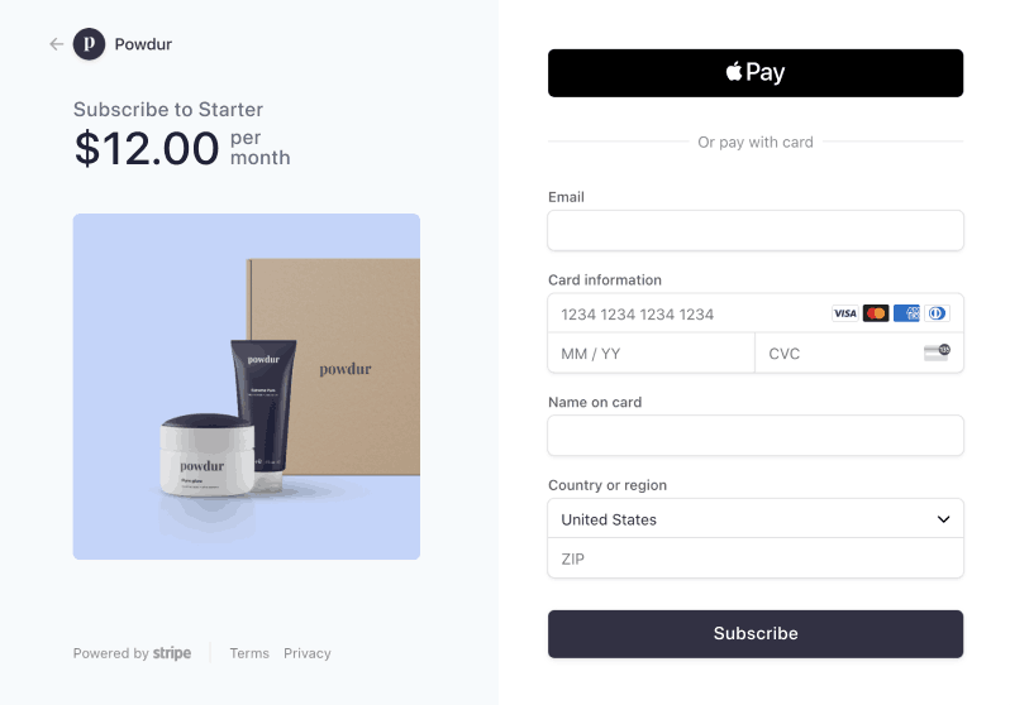

Source: Stripe Docs. Photo credit: Yulia Kopytko

1. Building a Production-Ready Subscription System

Setting up a subscription with Stripe can be deceptively simple – until it has to actually work at scale. In real-world systems, reliability, transparency, and lifecycle control matter just as much as payment success.

This section breaks down what it takes to go beyond the default Stripe flow and build a resilient, testable, and user-friendly subscription system.

Event-Driven Billing Logic

Stripe’s API is asynchronous by design. That means you can’t trust the immediate result of a subscription creation or payment action – you must wait for the appropriate webhook.

The absolute minimum webhook events to handle:

- invoice.payment_succeeded – confirms the invoice was paid

- invoice.payment_failed – failed charge, may enter retry logic

- customer.subscription.updated – plan or billing changes

- customer.subscription.deleted – cancellation, manual or automated

All access logic (e.g. “can this user use the app?”) should be driven by webhook state, not UI callbacks.

Best practice: Store the subscription lifecycle in your DB. Stripe is your source of truth, but your system should cache, display, and reason over it independently.

Handling Payment Failures Gracefully

Failed payments are inevitable. Stripe offers Smart Retries, but your product still needs to decide:

- When to notify the customer

- Whether to suspend access

- How to handle retries that fail again later

Common Stripe statuses and what they mean in practice:

| Status | Meaning | Action Needed |

| active | Payment succeeded | Grant full access |

| past_due | Payment failed, retrying | Notify, grace period? |

| unpaid | All retries failed | Consider access suspension |

| canceled | Subscription closed | Revoke access |

Stripe does not track “access logic” – that’s your job.

Tip: Create a platform-specific billing_status, such as:

- trialing

- active_paid

- active_unverified (e.g. pending ACH)

- suspended

- canceled

This gives you more control, especially when introducing trials and manual intervention.

Supporting ACH and Card Side-by-Side

Letting customers choose between card and ACH sounds user-friendly until you have to support it in code.

Key differences:

- Card payments are authorized immediately. ACH payments are not.

- ACH uses micro-deposits or Plaid verification. This adds steps and latency.

- ACH charges can fail days later (NSF or fraud).

You can’t treat “customer.subscription.created” as a green light, especially for ACH. Your system needs to track verification, hold access, and retry where appropriate.

Tip: In your UI, show a “pending verification” state for ACH-based subscriptions. Avoid activating accounts prematurely.

Trials, Cancellations, and Lifecycle Hell

Free trials aren’t “free” from complexity.

Common edge cases:

- Trial users who never attach a payment method

- Trial canceled manually before expiration

- Reactivation mid-trial (resume logic gets weird)

- Mid-trial plan changes (restarts trial? ends it early?)

Stripe allows customization (e.g. trial_end, cancel_at, pause_collection), but edge cases still need platform-side tracking.

To avoid surprises, define lifecycle transitions clearly:

- From trial to paid

- From canceled to resumed

- From paused to resumed

- From any state to unpaid

Track the dates involved. Stripe will enforce them for billing, but only you can enforce them for access.

Upgrades, Downgrades, and Invoice Timing

Proration logic in Stripe is flexible but requires configuration:

- Immediate billing on upgrade?

- Credit on downgrade?

- Wait until next cycle?

Also, invoices don’t finalize instantly. If you update a subscription mid-cycle, the resulting invoice may contain:

- Partial charges

- Adjustments

- Previews (if using upcoming invoice preview API)

Your product must align UX (e.g. “You just upgraded”) with Stripe’s actual billing behavior, including whether the invoice will even generate now.

Tip: Use invoice.upcoming API to simulate billing before making changes. Show users exactly what they’ll be charged and when.

Testing Subscription Logic – the Smart Way

Stripe’s dashboard is great for verifying happy paths. But what about:

- Simulating 3 failed payments in a row?

- Switching from ACH to card mid-trial?

- Catching missed webhook events?

You’ll need staging setups with:

- Full webhook replay support (Stripe CLI)

- Controlled Stripe test clocks (for trial flow)

- Manual invoice and subscription manipulation

Pro tip: Build a “test harness” where QA can force state transitions (e.g. past_due → unpaid → canceled) without waiting days.

2. Fees, Margins, and Accounting for the Unexpected

Stripe’s pricing may seem transparent, but in practice, building a subscription business means calculating revenue after fees, not before.

Most platforms only think about Stripe’s “2.9% + $0.30” headline fee. But in reality, the effective cost of payment processing depends on:

- The payment method (cards vs ACH)

- The customer’s geography

- The card brand (AmEx fees are often higher)

- Use of additional products like Stripe Tax or Connect

- Currency conversion and cross-border surcharges

Hidden Fees in Subscription Systems

In recurring billing models, fees are cumulative. For example:

- A $100 subscription paid via credit card may incur $3.20+ in fees.

- Add on a dispute or refund and the margin evaporates.

- If ACH is used, the cost may be lower (~0.8%), but the settlement is slower and failure risk is higher.

Even worse: if you use Stripe Connect to split revenue (e.g. marketplaces or platforms with vendors), you’re often charged twice – once for collection, once for payout.

Tracking Net Revenue

Stripe provides fee breakdowns in balance_transaction.fee_details. But that data is:

- Not included by default in webhook payloads

- Not persisted in most platforms unless explicitly saved

- Difficult to reconcile with product-side invoicing logic

Recommendation: Store invoice.charge.balance_transaction.fee_details whenever a payment is successful. Create a ledger model to compare gross revenue, Stripe fees, refunds, and payouts per transaction.

Why It Matters

Without this logic:

- Your dashboard shows fake profit

- Your vendors may get overpaid

- Your analytics can’t track real margin per customer

And worst of all: your finance team will hate you.

Pro Tip

Stripe is reliable, but it’s not your accountant. If you don’t track real net income on a per-user basis, you’ll miss critical signals like:

- Which plan is actually profitable

- How much failed payments are costing

- Whether your “discounted trial” users actually bring ROI

In subscription businesses, billing errors don’t show up immediately – they compound. Clean financial data = long-term survivability.

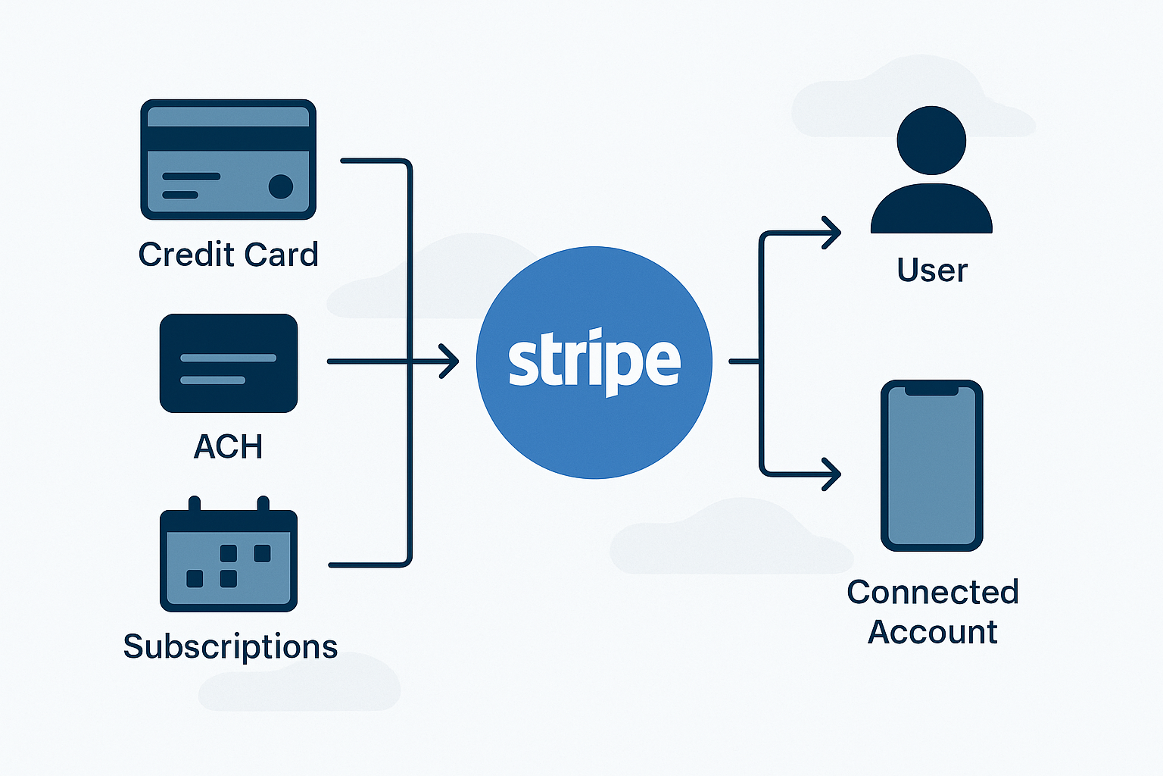

Source: Image generated via ChatGPT 4o by Yuliia Kopytko

3. Testing Stripe Subscriptions: Where the Sandbox Falls Short

Stripe offers one of the most developer-friendly test environments on the market. But while the sandbox is great for prototyping, it doesn’t always reflect the real behavior of subscriptions in production, especially when billing logic spans days, retries, and multiple payment methods.

If you rely solely on Stripe’s dashboard and a few test cards, you’ll miss critical failure paths.

What the Sandbox Gets Right

You can:

- Simulate successful and failed card payments using test card numbers

- Create trialing subscriptions with custom durations

- Use the Stripe CLI to replay webhook events

- Manually test checkout and customer portal flows

That’s a solid starting point.

What the Sandbox Can’t Simulate

But here’s where things break down:

- Webhook delays don’t happen. In production, webhook delivery may take seconds or get retried due to downtime. In test mode, it’s instant.

- ACH flows are not realistic. In test mode, ACH verifications and settlements are instant. In production, they may take 3–5 business days and fail days later.

- Payment retries are hard to simulate. You can’t natively test Smart Retry behavior over time.

- Disputes and refunds don’t have fully accurate event simulation in test mode.

- Subscription edge cases (resuming mid-cycle, invoicing errors, overlapping changes) are difficult to replicate without staging logic.

What You Should Be Testing and How

To go beyond Stripe’s sandbox:

Use the Stripe CLI

Replay webhook events with stripe trigger, inspect payloads, and test your event handlers under load.

Simulate billing state transitions

Build tools in your staging environment that force a subscription into states like:

- past_due

- unpaid

- paused

- canceled

Let QA test UI and access logic against these states without waiting days for real transitions.

Use test clocks (beta)

Stripe now offers Test Clocks, which simulate time passage. Perfect for testing:

- Renewals

- Trials expiring

- Proration after mid-cycle changes

Test missed webhook scenarios

Temporarily block your webhook endpoint. See how your system recovers when Stripe retries the event hours later.

Log everything

Log all incoming webhooks, whether handled or not. Alert on unhandled event types, failed JSON parsing, or duplicate processing.

Bonus: The “QA Control Panel” Pattern

Some teams build a private admin UI in staging that lets testers:

- Change customer payment methods

- Pause/resume subscriptions

- Mark a subscription as “unpaid” or “trialing”

- Trigger invoice previews and upcoming bills

This dramatically improves coverage and speed and helps non-engineers verify billing behavior safely.

Pro Tip

Treat subscription logic as if it were a banking system.

That means repeatable tests, auditable logs, and staging flows that mimic the messy parts of real payments – not just happy paths.

Conclusion

Building subscription logic with Stripe means more than just enabling recurring payments. Real-world systems must account for failed charges, delayed settlements, proration quirks, verification workflows, and edge-case transitions between trialing, paused, and unpaid states.

Stripe gives you an excellent foundation, but it doesn’t enforce how you interpret subscription statuses, handle retries, or reconcile fees. That responsibility falls on your system architecture, billing models, and internal access control logic.

The most resilient implementations treat billing as a distributed, stateful process. They separate payment intent from access logic, log and replay every event, and keep financial accuracy front and center.Stripe does the charging.

Your platform does the thinking.

And if you need help building subscription logic that works reliably in production – from webhook-driven billing flows to multi-method payment support, test harnesses, and revenue reconciliation – our team at Fordewind.io designs and implements scalable subscription systems for platforms of any size.

We can help you architect, build, and optimize a subscription infrastructure that’s stable, predictable, and ready for growth.